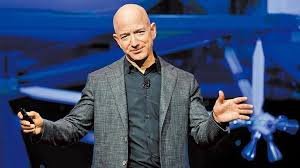

In a strategic move, Amazon founder Jeff Bezos has disclosed plans to sell up to 50 million shares of Amazon.com Inc. over the next 12 months, leveraging the recent surge in the company’s stock. The announcement comes on the heels of Amazon reporting its strongest online sales growth since the early stages of the pandemic, propelling its shares to a nearly 8% rally, reaching $172.

Bezos’ decision to sell shares aligns with the significant increase in Amazon’s stock value, bringing him closer to potentially reclaiming the title of the world’s richest person. Following the stock surge, Bezos’ wealth saw a remarkable jump of $12.1 billion on Friday, narrowing the gap with current leader Elon Musk to $8.1 billion, according to the Bloomberg Billionaires Index. Bezos hasn’t held the top position on the index since 2021, and the dynamic between the two billionaires has been shaped by the divergent performance of Amazon and Tesla Inc. shares.

The Amazon co-founder, aged 60, has adopted a trading plan that allows him to sell 50 million shares at any time before January 31, 2025, with an estimated value of approximately $8.6 billion at the current share price. This marks the first time Bezos plans to sell Amazon stock since 2021, though he did make a single share purchase in May, his first recorded acquisition in records dating back to 2002.

The disclosure of planned stock sales by Bezos and other key figures at Amazon comes in compliance with new Securities and Exchange Commission rules, designed to enhance transparency for corporate insiders engaged in pre-arranged trading plans. Amazon, in its annual report, provided details on the intended stock sales by Bezos, board members, and senior executives.

The move by Bezos to sell Amazon shares coincides with his recent announcement of relocating from the Seattle area to Miami. While this move may impact Washington state’s potential tax windfall from the share sale, as Washington has recently introduced a capital-gains tax, Florida, where Bezos is moving, does not have such a tax.

As Bezos navigates these strategic financial moves, observers are keenly watching how the dynamic between him and Elon Musk evolves, especially as both tech titans make strategic decisions in their personal and business pursuits.

Sources By Agencies

Digital Scoop India Official Platform of Digital Scoop India Featuring Latest & Best News #Articles #Bytes #Entertainment #DigitalScoopMagazine

Digital Scoop India Official Platform of Digital Scoop India Featuring Latest & Best News #Articles #Bytes #Entertainment #DigitalScoopMagazine